You’ve just had a major car accident and we need to hospitalize you for a week. How much is your recovery worth? You gotta pay if you wanna stay!

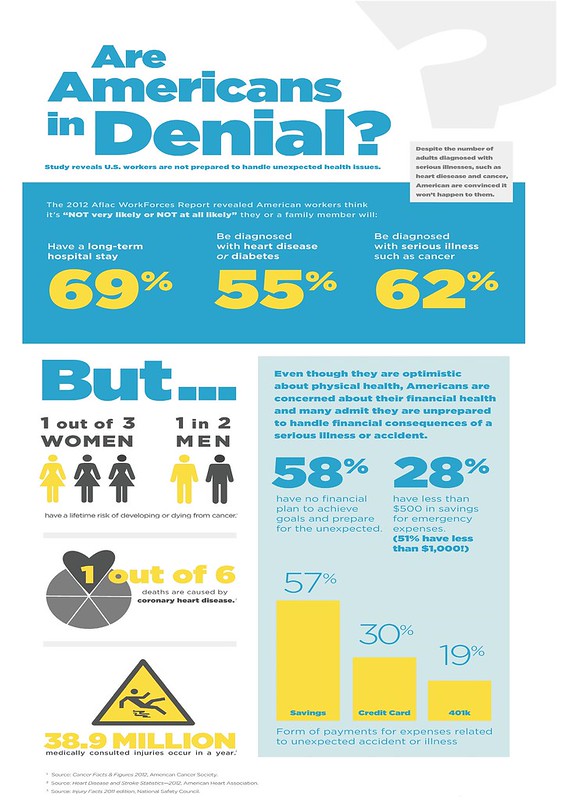

This is what happens everyday in our country. Unfortunately many of us are in denial about the possibility of major unexpected events happening to us. See how this recent study shows how optimistic people are:

Not to be morbid or a pessimist, but here’s the reality:

- In 2012, around 2.36 million people were injured in car accidents and 33, 561 died.1

- Every 34 seconds someone suffers a heart attack and in 2010 1.9 million new cases of diabetes are diagnosed for people 20 and older (results are over 1,900 deaths a day).2

- 1 in 2 men as well as 1 in 3 women will be diagnosed with cancer in their lifetime (results are over 1,500 deaths a day).3

- Over 37 million Americans are classified as disabled; about 12% of the total population. More than 50% of those disabled Americans are in their working years, from 18-64.4

- The average length of a hospital stay is 4.8 days and it costs an about $10,000.5

Now having the wool pulled off of you, what are you doing to prepare?

Unfortunately it is not a question of it things will happen, but when will they happen and how will you handle them. It’s bad enough these events are physically, mentally, and emotionally straining, but adding the financial aspect is adding insult to injury (no pun intended).

Quite simply, as I always say:

- http://www.nhtsa.gov

- http://www.heart.org , http://www.diabetes.org

- http://www.cancer.org

- U.S. Census Bureau, American Community Survey, 2011

- The Healthcare Cost and Utilization Project, sponsored by the Agency for Healthcare Research and Quality.